Schedule a Demo Workday Adaptive Planning Webinars Workday Adaptive Planning Blogs

What is Workday Adaptive Planning? | What is Workday Adaptive Planning Used For? | Who Uses Workday Adaptive Planning? | Can Workday Adaptive Planning Replace Excel? | Why Should I Care?

What is FP&A?

FP&A stands for Financial Planning & Analysis and plays a critical role in financial management, corporate performance monitoring, and overall decision-making. FP&A teams consolidate and analyze financial data, prepare yearly budgets, and develop forecasts to inform management-level decision-making. The overall goal of FP&A teams is to help the business understand their financial performance, identify trends and opportunities, and leverage data in making decisions to achieve yearly, quarterly, and monthly objectives.

What is Workday Adaptive Planning?

Business Answer:

Workday Adaptive Planning is a cloud-based software solution that makes it easier for FP&A teams to execute Annual Operating Plans, yearly budgets, monthly or quarterly forecasts, KPI development, and holistic company-wide reporting. Adaptive is meant to be operated and maintained by FP&A teams, removing the dependency on IT or other functional areas.

Technical Answer:

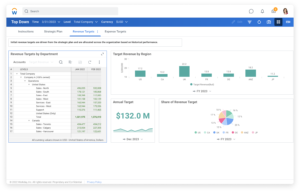

Workday Adaptive Planning supports businesses of any size and industry in their pursuit to streamline and optimize FP&A processes by connecting to General Ledger systems like Sage or NetSuite (and others!), building multi-dimensional models (Revenue, Opex, Workforce Planning, Capital, etc.), developing a KPI dashboard and management deck for executive leadership teams, and many other tasks necessary to the FP&A function. The low-code environment and Excel-like formula syntax makes for a smooth transition for all FP&A practitioners.

Capitalize has helped build budgeting/planning/and forecasting models for:

- Manufacturing

- Retail

- Logistics

- Oil and Gas

- Tax

- Software as a Service

- Healthcare

- Aviation

- Hospitality

What is Workday Adaptive Planning used for?

Business Answer:

Workday Adaptive Planning is used to reduce the time it takes FP&A and finance departments to execute their yearly, quarterly, monthly, weekly, and daily tasks. Tasks that require weeks and months during an Excel-based FP&A process are reduced to minutes and hours utilizing Adaptive.

Technical Answer:

Workday Adaptive Planning is a one-stop shop for consolidating operations and financial data, dynamic model building, version iteration and control, and internal/external reporting. The multi-tenant environment allows FP&A and their business partners, plus leadership, to collaborate in a central source of truth for historical and forward-looking purposes, simultaneously increasing accuracy, security, scalability, and audibility.

- Connect to and consolidate multiple disparate data sources

- We like to classify Workday Adaptive Planning as a ‘data-agnostic’ tool, meaning it can connect to almost any data source from which we can manually pull data. Whether it’s a data warehouse, GL system, ERP, or CRM, Workday Adaptive Planning centralizes the data we require for holistic company analysis.

- Consolidation of historical actuals, budgets, and forecasts

- One of the biggest pain points across FP&A and finance departments is the time it takes to consolidate historical data, yearly budgets, and quarterly/monthly forecasts. The reason it’s so time-intensive is because it’s manual! Workday Adaptive Planning gives FP&A departments the power to quickly and accurately consolidate P&L’s so more time can be spent on high-impact tasks, like analyzing the data and developing strategic paths forward.

- Version creation, iteration, and security

- How many budget cycles end with the appropriately titled ‘Final Budget_V8_CTMEdits_Approved_12312023’? Too many! With Workday Adaptive Planning, creating new versions, rolling versions into forecasts, and locking down any and all versions is efficient and simple. Add in the streamlined consolidation capabilities mentioned above and you’ll start to see the time spent in budget cycle reduced significantly.

- Model updates, scaling, and validation

- Imagine you’re budgeting Operating Expenses (OpEx) for 50+ branches and you’re on the third version of the budget. If you’re modelling OpEx, chances are you’ve updated those 50 Excel files twice already and are moving to a third, not to mention the time consolidating those updates into ‘Budget_V3.’ Workday Adaptive Planning allows FP&A practitioners to make updates to any models that cascade across all branches and consolidate efficiently to the Overall Company level, reducing the time it takes to iterate through planning changes.

- Scenario analysis and rolling forecasts

- One of the main functions of an FP&A department is to analyze macro- and micro-economic conditions, investigate various scenarios, and determine impact on the business. Combining streamlined version creation and efficient model update capabilities, Workday Adaptive Planning enables FP&A departments to run true, accurate scenario analysis. Constant Currency, What-If-COVID-Happens, ProForma Analysis, and other scenarios are at the fingertips of FP&A departments, enhancing their impact on strategic decision-making.

- Internal and External Reporting

- Whether it’s an integrated 3-model statement in the form of Income Statement, Balance Sheet, and Cash Flow, or KPIs tracking performance across the company, Workday Adaptive Planning provides dimensional web-based and Office365-based reporting. For quick insights, the web-based reporting is intuitive and easy-to-use. The integration with Excel, Word, and PowerPoint streamlines the maintenance of detailed board decks, giving FP&A teams more time to analyze and interpret the data and drive the strategic growth conversation.

Who uses Workday Adaptive Planning?

Business Answer:

Workday Adaptive Planning is currently being used by 5000+ companies across industry, geographic location, and functional area – Finance, HR, Sales, Operations, and other functional areas are now centralized rather than siloed. By enabling quick access to data and insights, as well as dynamic and intuitive modelling functionality, Workday Adaptive Planning democratizes the planning process and enables company-wide collaboration.

Technical Answer:

Workday Adaptive Planning empowers companies to scale their modelling practices and set the foundation for accurate financial analysis. The low-code experience enables financial analysts to build dynamic models regardless of complexity, leading to greater collaboration with business partners and various functional areas. FP&A Directors and Managers have access and insight into model logic, adjustments, user activity, and results to ensure accuracy and completeness. At the highest levels, vice presidents of finance and CFOs have quick access to dashboards and reports containing important KPIs and data points that assist in driving strategic decisions. Rounding out the company, IT plays a huge role in controlling the data sources we connect to and auditing user access through mechanisms like SSO (Single Sign-on).

Can Workday Adaptive Planning replace Excel?

Business Answer:

Workday Adaptive Planning cannot and will not replace Excel. As the most used data tool in the world, and particularly in Finance and FP&A, Excel is here to stay. Workday Adaptive Planning can, however, replicate, streamline, and optimize current Excel processes while providing the runway for scaling all modelling practices. The goal is not to replace Excel, but rather find the combination of tools that work in concert with Excel to optimize our skillset and maximize time. Workday Adaptive Planning is that tool.

Technical Answer:

We are not psychic, but we do not anticipate Excel going anywhere anytime soon. It is too flexible, intuitive, and dynamic. That said, business will continue to grow and scale in complexity, placing greater demands on FP&A departments and their modelling methodology. It is this inflection point where Excel begins to wobble and show lack of scalability, opening the door for a tool like Workday Adaptive Planning to work together with Excel in creating an agile, powerful FP&A function.

Why should I care?

Time is our most valuable resource. As business cycles move faster and faster, maximizing time is of the utmost importance in planning and analyzing the financial health of an organization. Decisions that were once made over stretches of time are now made daily. As much as we try to make light of it, five-month budget cycles are unacceptable, inefficient, and out-of-date by the time they’re finished. Workday Adaptive Planning significantly reduces the time it takes to build an Annual Operating Plan, run a quarterly or monthly forecast, build a variance report, analyze currency fluctuation impact, and many other tasks necessary for an optimized FP&A team without compromising accuracy and completeness. The formula is quite simple: Company-wide participation + security and audibility + dynamic modelling and reporting = Scalable FP&A Solution. That’s Workday Adaptive Planning.

Interested in learning more? Click here to join our email list to learn more about Workday Adaptive Planning.