Intelligent Gas Balancing

Do you spend hours printing and mailing Gas Balancing? Are you in compliance with your Gas Balancing Agreements?

Do you have to go to multiple places to obtain Gas Balancing Statements? Are some of the statements you need not in electronic form?

Do you spend more time gathering and compiling than analyzing?

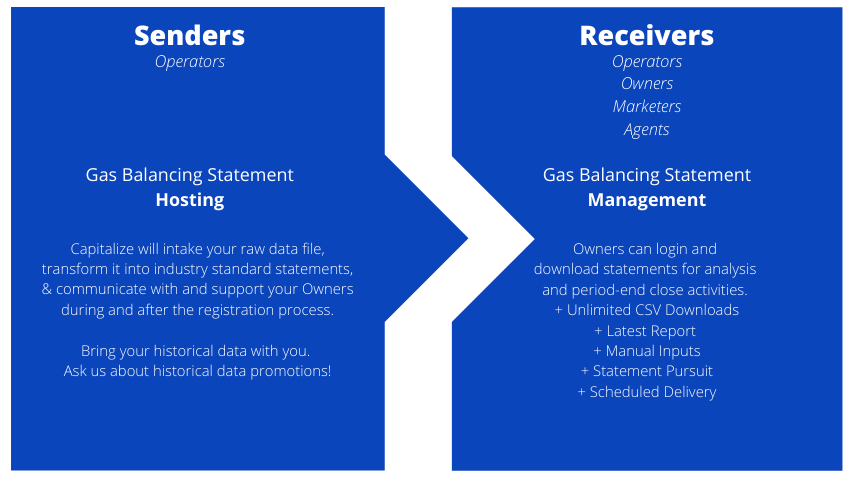

iGB sends and receives gas balancing statements on a single platform, allowing your team more time to focus on delivering value.

Oil & Gas Operators must provide Gas Balancing statements to Owners. This requirement is typically considered low-value-adding but remains time-consuming and requires significant resources.

Additionally, when an Operator has Non-Operated joint ventures, Gas Balancing statement information must be collected from other Operators, in varying formats and frequencies, and standardized for period-end close activities.

Need a one-page Product Summary to show your team? Click here for Product Summary

BENEFITS

MODERN TECHNOLOGY

Latest technology stack

Fast performance

AWS

KNOWLEDGE SUPPORT

Supported by experienced industry professionals

Designed for Gas Balancing

EASE OF REPORTING

Single platform for all Gas Balancing needs

Standardized statement layouts

ANALYTICS

Optimized schema for big data analytics

Analytical reports

Contract Compliance

The Gas Balancing Exhibit to the Joint Operating Agreement requires the Operator to publish Gas Balancing statements to Owners on a defined frequency. By simply sending a file to iGB, compliance is achieved.

By publishing timely Gas Balancing statements, Owners can confirm that their working interest revenue checks correlate to the decimals and ‘Takes’ reflected on the Gas Balancing statements and report any concerns on time to avoid lengthy historical prior period adjustments.

Risk Reduction

FEATURES

Latest Report

(The only report you’ll ever need)

iGB offers a custom report that contains the Latest revision of the Latest sales date for all statements in the Capitalize inventory. This expedited means to obtain all that is needed for period-end close or A&D analysis allows analysts to refocus on delivering value to the organization.

iGB Roadmap includes an API cross-reference solution to obtain your Non-Operated statements by API rather than by third party identifiers. This creates days of additional time savings.

API Matching Functionality

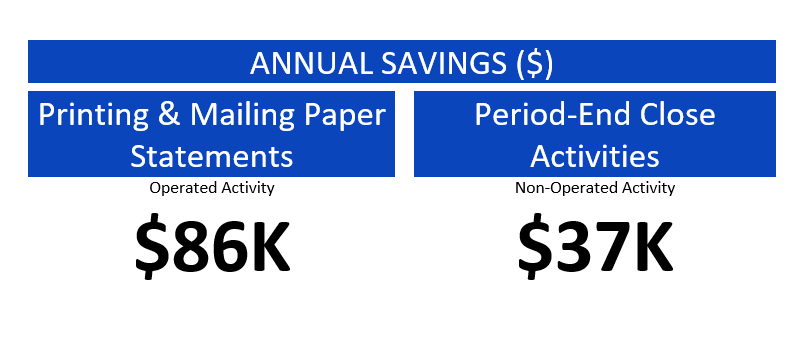

BUSINESS CASE

*based on Operator with wellhead Gas Balancing across 800 owners and 400 non-Operated wellhead Gas Balancing statements across 10 other Operators

If your Non-Operated portfolio is comprised of more than 200 wells, you are under-served by hosting your Gas Balancing statements elsewhere.

The effort to gather and prepare this information manually defers value-added analysis until time runs out each month. Capitalize Consulting’s iGB takes all the tedious work out of Non-Operated Gas Balancing management.

Our Business Case is hard to beat in cost savings and delivering value. Download our Business Case below.

ADDITIONAL SERVICES

- Due Diligence for Acquisition and/or Divestment -

- Non-Operated Gas Balancing Management -

- Gas Balancing Accounting, Full Service -

- Onboarding, Training & Best Practices -

- Settlement Valuation & Facilitation -

- Marketing Letter Management -

- Process Optimization -

“After 16+ years in the industry and obtaining a view from Accounting, Marketing, Midstream, as well as SaaS and Product Ownership, my frustration maxed out. As one of the most overlooked and misunderstood processes in the Gas Revenue Value Chain, it seemed my former boss was correct… ‘No one cares about Gas Balancing’.

Except me. I care. I love Gas Balancing. I see the tremendous value potential and I enjoy the challenges it relentlessly brings to the table.”

- Hallye Shrum, Creator of iGB