Is it Worth it to Switch to Modern Accounting?

Traditional manual accounting processes are just not sustainable in today’s working environment. Outdated processes are risky and expensive, so organizations are seeking ways to migrate towards modern accounting.

Why is change necessary?

The modern business environment is more demanding than ever on accounting. Our clients experience:

- more compliance and regulatory oversight.

- more business model changes from digital disruption.

- more demand for analytics and business partnering.

We are seeing that not only is manual accounting time-consuming, it also drains resources – you can’t simply keep throwing more bodies at the process. With this comes an increase in risk of human error, which could expose your organization to penalties and fees due to noncompliance, and even lawsuits.

Accuracy in accounting and finance is important, and yet it is often difficult to produce. Why?

- There are many people in finance and accounting involved across various, often inconsistent processes.

- These processes are made more difficult by the fragmented technology and disconnected data from multiple ERPs, subledgers, banks, and other sources.

- Unifying and reconciling this data usually requires extensive use of spreadsheets and huge amounts of manual, repetitive work.

- Further, this requires communicating updates and progress with many meetings, phone calls, emails, and instant messages.

- Reliance on in-person meetings, emails, spreadsheets, and paper files is proving more difficult, if not entirely impossible in some cases.

Implementing Modern Accounting

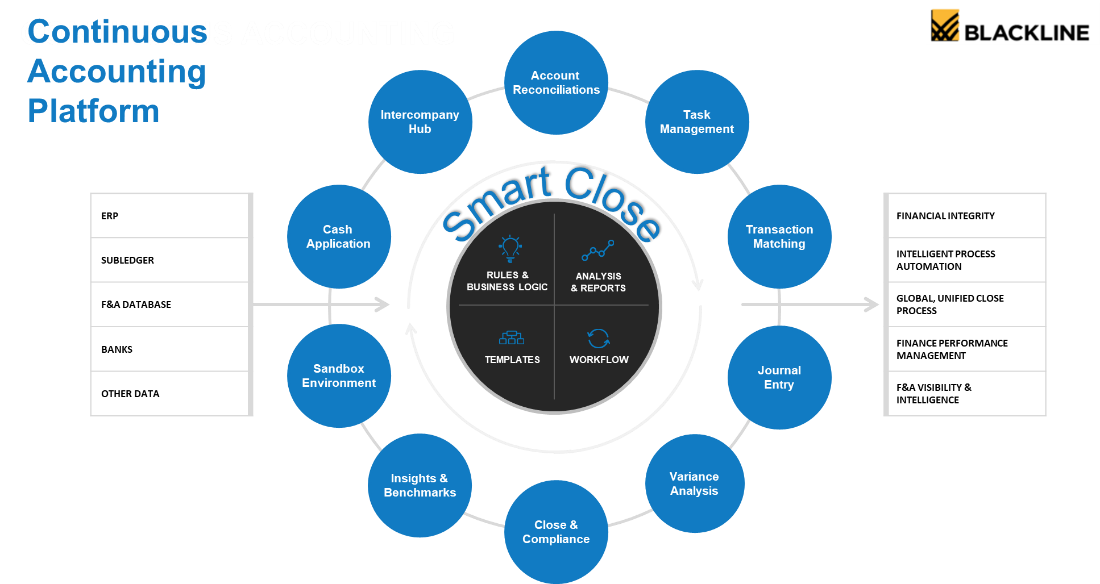

Making a move to modern accounting with BlackLine will help your company complete your accounting work more efficiently, in less time, and with greater control.

Modern Accounting is unified, collaborative, and achievable. It enables you to adapt to virtual close processes with confidence in uncertain times.

There are many facets to accounting, so where does BlackLine fit in?

- BlackLine supports activities not managed by your ERP but are critical for business stakeholders and their performance analysis, planning, and decision making.

- Without disrupting your current finance tech stack, BlackLine is a complementary solution to your general ledger.

- BlackLine fits directly in the middle of your record-to-report process, picking up where your system(s) typically leave you to work in spreadsheets on things like close checklists and account reconciliations.

Contemplating the Move to Modern Accounting? BlackLine helps you:

- manage your financial close processes.

- ensure balance sheet integrity.

- drive accountability and partnership through visibility.

- enable a remote audit.

Most importantly, BlackLine helps you automate repetitive work so you can focus resources on more pressing needs.

If you are interested in discussing how BlackLine can benefit your organization, email info@capitalizeconsulting.com to request a meeting with one of our Blackline specialists today.