BlackLine empowers users to accomplish tasks that are manually performed in Excel or that IT departments must develop. It is used by more than 1,500 companies around the world to modernize the accounting playbook, to ensure balance sheet integrity, and to increase confidence in their financial statements. Because BlackLine is web-based, it requires no software administration and can be implemented in as little as three months, with very little involvement from IT to get up and running.

Let’s explore the unique features that BlackLine offers and why they are important.

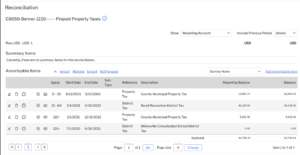

Account Reconciliations:

BlackLine automates and standardizes the reconciliation process, which contributes to higher quality financial statements. A few examples are bank reconciliations, intercompany reconciliations, and fixed asset reconciliations. Within the reconciliation, users substantiate balances, investigate discrepancies, attach supporting documentation, and document required adjustments, making BlackLine a central repository for all reconciliation items. The BlackLine reconciliation certification workflow requires certifications from a preparer, an approver, and an optional reviewer.

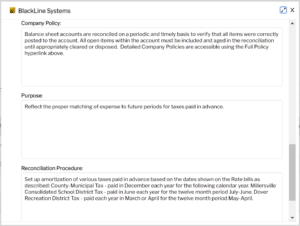

Documenting your organization’s policies and procedures is a critical component of a strong financial management system and is a benefit to teams experiencing turnover or additional hiring. BlackLine provides Policy, Purpose, and Procedure fields for each account reconciliation, answering questions such as what the account is used for, how often balances change, and how to complete the reconciliation. It allows for control owners to proactively update process documentation to keep up with evolving accounting standards and reporting regulations.

Automation:

One of the ways in which account reconciliations can be automated is through auto certifications. Based on a pre-set group of rules and conditions, low-risk, rules-driven reconciliations can be automatically certified without manual intervention by the Preparer, Approver, or Reviewer. BlackLine has reported that clients see anywhere from 43-85% of their accounts auto-certify, which can add up to many hours of saved work. Accounts can commonly auto-certify because there was no change in account balances month over month, balances are zero, or a previously approved amortization schedule matches the GL.

Another key step towards the automation of account reconciliations is via BlackLine’s transaction matching engine. One of the most tedious processes that accountants face on a monthly basis is matching transactions from the General Ledger to a supporting system, such as a bank statement. Often, this is done manually by ticking and tying transactions with spreadsheets and multiple monitors.

Manually ticking and tying transactions across spreadsheets is error prone and time consuming. BlackLine Transaction Matching is a rules-driven engine that allows millions of transactions from different systems to be consolidated and automatically matched without any manual effort. With BlackLine Transaction Matching, data from the GL and supporting systems are automatically loaded throughout the month. Rules are created to indicate how to match the transactions against each other, resulting in far less time being spent on manual transaction matching. Transaction Matching helps to find any matching exceptions quickly, so the Preparers need only work through the Unmatched Transactions. Some common use cases for BlackLine Transaction Matching are:

- Bank to Credit Card to GL transactions (3-way matching)

- Intercompany Reconciliations

- Point of Sale system to Credit Card transactions

Task Management:

Utilizing a hierarchical task list, workflows, and real-time dashboards, the Task Management product allows users to track and control a variety of task types, most commonly being month-end close checklists and PBC lists.

Since virtually every data point in BlackLine is reportable, management-level reports can give visibility into the global close calendar.

Teams in BlackLine:

Teams can be assigned to tasks in BlackLine, which is useful for productive redundancy purposes, such as when one team member is out of office. Users assigned to the same team can assist each other with their workload and assignments.

Reporting:

Nearly every single data point in BlackLine is reportable using BlackLine’s easy-to-use report writer, which features both grids and visualizations. As you edit the report, the data updates in real time, resulting in fast development times. Reports provide insights that lead to increased company productivity. There is a plethora of pre-built reports that answer questions like:

- What impact will potential adjustments to the general ledger have on my financials?

- How many account reconciliations are incomplete and what are the material risks at play?

- Which account fluctuations are above a materiality threshold?

- What percentage of reconciliations are getting rejected?

- What percentage of tasks are being completed on their due dates?

- Which tasks take users the most time to complete?

An integrated reporting tool centralizes issue management. All stakeholders have visibility into findings so there are no surprises at the end of the audit period.

Variance Analysis:

BlackLine’s variance analysis functionality automates the calculation of flux between budgets, forecasts, and actuals, and presents a purpose-built user interface designed for users to submit variance analyses. This replaces manual, spreadsheet-driven processes prone to user error. It also provides the opportunity for an approval layer, thus ensuring that your business is audit ready. BlackLine automatically monitors for fluctuations using precise variance rules that are completely customizable to your organization’s needs.

Automated Journal Entries and Journal Entry Approvals:

One of the more advanced features that BlackLine offers is journal entry automation, which enables your organization to create, review, approve, and automatically post directly to the ERP system. Journal entries can also be automatically generated based on underlying business logic, such as amortization schedules.

Security:

Your IT organization can feel comfortable knowing that BlackLine maintains the best-in-class ISO/IEC 27001 security certifications. According to BlackLine, their service has maintained uptime of 99.98%, driving continuous, reliable access. SSAE 18 SOC 1 and SOC 2 Type II reports are also published annually. Protection measures also include documented APIs, TLS cryptographic protocols to provide a secure encrypted connection, firewalls, disaster recovery services, and third-party penetration testing. For enhanced security and a more seamless user experience, login access can be configured with SSO (single sign on). You can find more information about BlackLine’s security measures here. To learn more about BlackLine’s security, please visit Trust BlackLine.

Watch our webinar to learn more about BlackLine.

Ready to get started? Contact us at info@capitalizeconsulting.com today!