Top 5 FP&A Tools in 2026: A Practical Buyer’s Guide for Finance & Analytics Leaders

Choosing the right FP&A software in 2026 is no longer just about budgeting. Modern FP&A platforms must support driver-based forecasting, cross-functional planning, governed workflows, and clean integration into the enterprise analytics stack, without creating a disconnected “shadow planning system.”

This guide ranks the top FP&A tools in 2026 based on real-world implementation patterns and operating model outcomes. It is written for CFOs, finance leaders, and analytics teams evaluating financial planning and analysis platforms that scale with governance, automation, and analytics consumption in mind.

Summary:

The best FP&A tools in 2026 are those that balance modeling depth, governance, integration, and maintainability and can publish analytics-ready outputs into BI and data platforms. Tool selection alone is not enough; operating model and implementation discipline determine long-term success.

How We Evaluated the Best FP&A Software (2026)

This ranking reflects Capitalize Analytics’ experience implementing FP&A platforms across enterprise and mid-market organizations. Scores (0–5) reflect typical product positioning and implementation outcomes, not edge-case configurations.

Weighted Scoring Model

- Planning & Modeling Depth (30%)

Driver-based planning, scenarios, multi-dimensional models, cross-functional support - Workflow & Governance (20%)

Approvals, audit trails, RBAC/SoD, change controls - Integration & Data Management (20%)

ERP/GL/CRM connectivity, automation, reconciliation - Reporting & Analytics Experience (15%)

Variance analysis, dashboards, narrative outputs, BI consumption - Maintainability & Time-to-Value (15%)

Admin ownership, implementation complexity, model change effort

Top 5 FP&A Tools in 2026 (Ranked)

| Rank | FP&A Tool | Weighted Score |

| 1 | Workday Adaptive Planning | 4.4 |

| 2 | Anaplan | 4.3 |

| 3 | Pigment | 4.1 |

| 4 | Oracle Cloud EPM | 4.1 |

| 5 | Planful | 3.9 |

FP&A Software Comparison Matrix (2026)

| Tool | Modeling (30%) | Workflow (20%) | Integration (20%) | Reporting (15%) | Maintainability (15%) | Score |

| Workday Adaptive Planning | 4.4 | 4.4 | 4.3 | 4.1 | 4.4 | 4.4 |

| Anaplan | 4.7 | 4.2 | 4.1 | 4.0 | 3.8 | 4.3 |

| Pigment | 4.3 | 4.0 | 3.9 | 4.1 | 4.1 | 4.1 |

| Oracle Cloud EPM | 4.4 | 4.5 | 3.9 | 3.9 | 3.4 | 4.1 |

| Planful | 3.9 | 4.0 | 3.8 | 3.9 | 4.0 | 3.9 |

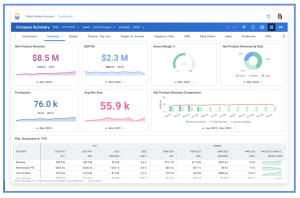

- Workday Adaptive Planning — Best Overall FP&A Platform

Best for: Finance-owned FP&A teams prioritizing maintainability and repeatable forecasting cycles.

Workday Adaptive Planning consistently ranks as the strongest overall FP&A software for organizations that want balanced modeling power without sacrificing usability. It performs well across all evaluation dimensions, particularly Maintainability & Time-to-Value, making it a strong choice for finance teams that want to own their planning models long-term.

Why it ranks #1

- Strong driver-based modeling for most FP&A use cases

- Finance-friendly administration and change management

- Reliable workflow controls for recurring planning cycles

- Clean integration patterns when actuals and drivers are standardized

Bottom-line:

Workday Adaptive Planning is best suited for organizations that want FP&A tightly governed and analytics-ready without heavy IT dependency.

- Anaplan — Best for Complex, Cross-Functional Planning

Best for: Enterprises where modeling depth and connected planning outweigh admin simplicity.

Anaplan excels when multi-dimensional, cross-functional planning is the primary requirement. Its modeling flexibility supports advanced driver trees and scenario planning, but that flexibility must be paired with strong governance to avoid long-term maintainability issues.

Key strengths

- Industry-leading modeling depth

- Strong fit for connected planning across finance, sales, and operations

- Powerful scenario analysis when standards are enforced

Trade-off:

Without disciplined ownership, model sprawl can increase admin burden.

- Pigment — Best for Modern Collaboration

Best for: Teams prioritizing speed, collaboration, and iterative planning cycles.

Pigment is often selected by organizations seeking a modern FP&A experience with strong stakeholder engagement. It performs well in modeling and reporting, especially when planning outputs are quickly looped into analysis.

What to watch

- Integration success depends heavily on data discipline

- Source-of-truth definitions must be locked early

Bottom-line:

Pigment works best when paired with strong data pipelines and reconciliation controls.

- Oracle Cloud EPM — Best for Governance & Control

Best for: Enterprises prioritizing standardized finance processes and auditability.

Oracle Cloud EPM is frequently chosen for its robust workflow, controls, and enterprise governance posture. It is well-suited for regulated environments but can feel heavier than finance-first tools depending on implementation approach.

Strengths

- Strong approval workflows and audit trails

- Enterprise-grade planning and modeling

- Effective management reporting

Consideration:

Maintainability depends on operating model and admin specialization.

- Planful — Best for Pragmatic FP&A Teams

Best for: Teams seeking structured planning without enterprise-suite overhead.

Planful delivers reliable support for budgeting, forecasting, variance analysis, and reporting. It’s often selected by teams that want predictable FP&A cycles with manageable administration.

Why teams choose Planful

- Solid workflow for recurring FP&A processes

- Finance-team ownership

- Good balance of structure and simplicity

Other FP&A Platforms Often Shortlisted

- Prophix

Popular with mid-market teams prioritizing fast deployment, lower TCO, and finance-led automation.

- OneStream

Strong choice when financial close, consolidation, and planning must live in a single governed footprint.

FP&A Implementation Matters More Than the Tool

Selecting FP&A software is only half the equation. The real differentiator is whether planning becomes a governed part of your analytics ecosystem instead of a disconnected forecasting exercise.

A strong FP&A implementation should address:

- Operating model alignment (finance-owned vs IT-assisted)

- Data foundation integration (ERP, GL, CRM, HRIS with reconciliation)

- Analytics-ready outputs for BI and KPI layers

- Governance without slowdown (RBAC, audit trails, certified drivers)

- Adoption & enablement to deliver value in the first planning cycle

FAQs: Choosing the Right FP&A Tool

Should organizations standardize on one FP&A tool globally?

Usually yes. Multiple tools increase reconciliation, governance, and support overhead.

What determines FP&A success more: the platform or the operating model?

The operating model. Clear ownership and data discipline matter more than features.

Planning-first or consolidation-first FP&A software?

Choose consolidation-first when close complexity dominates; planning-first when forecasting agility drives decisions.

Biggest FP&A implementation risk?

Weak data discipline resulting in unclear hierarchies, inconsistent drivers, and poor reconciliation.

Evaluating FP&A tools for your organization?

Schedule your FP&A platform assessment today!

Capitalize helps organizations implement FP&A platforms that scale, reconcile, and integrate cleanly into enterprise analytics, so planning actually drives decisions.